- 24 Oct 2025

- 3 Minutes to read

Permanent allocation

- Updated on 24 Oct 2025

- 3 Minutes to read

Permanent allocation allows you to receive a non-expiring notional (virtual) allocation of 100,000 EUR if you reach a selected target return from the feature's purchasing moment, or an instant permanent allocation with no target return. It is important to note that the performance benchmark corresponds to your DARWIN and not to your manual trading account. The performance target of your DARWIN is the one selected at the time of purchase or immediately upon acquisition of the permanent allocation of capital without a performance target.

When can it be purchased?

The service can be purchased at any time given the following criteria is met:

- Calibration stage is completed and the DARWIN has been created.

- The DARWIN doesn't have open trades, or if there are any open trades, underlying markets of those open trades must be within open hours*.

In other words, it will be always be open to purchase unless the DARWIN is not created yet or there are any open trades with underlying markets closed.

*The option will be disabled between 17:00-18:00h (New York time zone), to avoid times of high volatility.

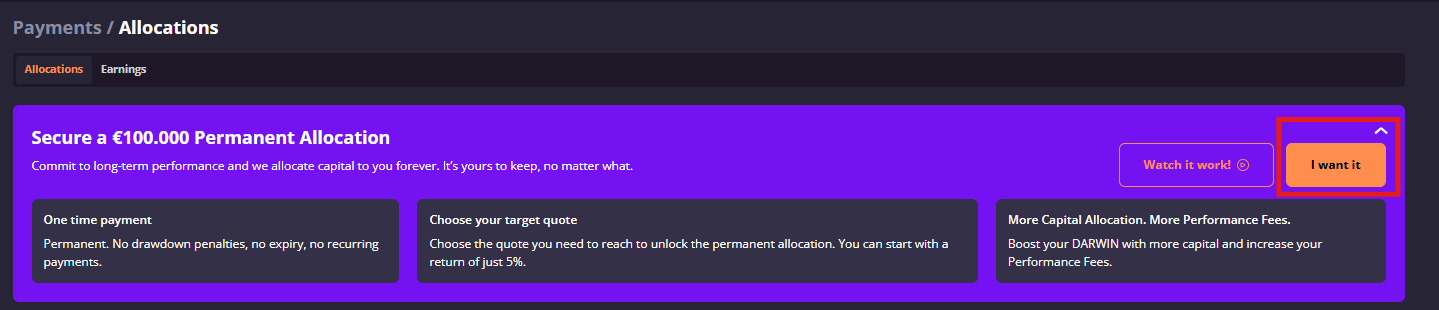

The option is available on your account settings, on the section payments->subscriptions:

What are the return targets to receive the permanent allocation?

There are four return targets offered: 5%, 10%, 15%, or 20%, and one option to purchase an instant permanent allocation with no target return. The higher the return target, the lower the cost of the service:

| Target return | Price (EUR | Price (USD) |

|---|---|---|

| None (instant) | 1795€ | $1995 |

| 5% | 995€ | $1095 |

| 10% | 535€ | $595 |

| 15% | 355€ | $395 |

| 20% | 265€ | $295 |

Thus, there are 2 types of permanent allocations:

- No target return requirement: The instant permanent allocation does not require a target return, it is obtained automatically after purchase.

- With target return: The allocation is obtained after achieving the selected target return with your DARWIN since the moment of purchase.

In the case of a purchase to acquire the immediate equity allocation the quoted price at which it enters is at the close of the current minute, once the trade is completed.

With regard to permanent return-based capital allocations, if you prefer to have a better chance of receiving the permanent allowance, you can pay 995€* and if your DARWIN achieves 5% return from the purchasing point, your DARWIN would receive the allocation. If, on the other hand, you want a tougher challenge at a lower price, you may pick the last option by paying 265€* and needing a 20% return to receive the allocation.

*Credits received either by member-get-member codes or unwithdrawn performance fees obtained can be used to pay the permanent allocation

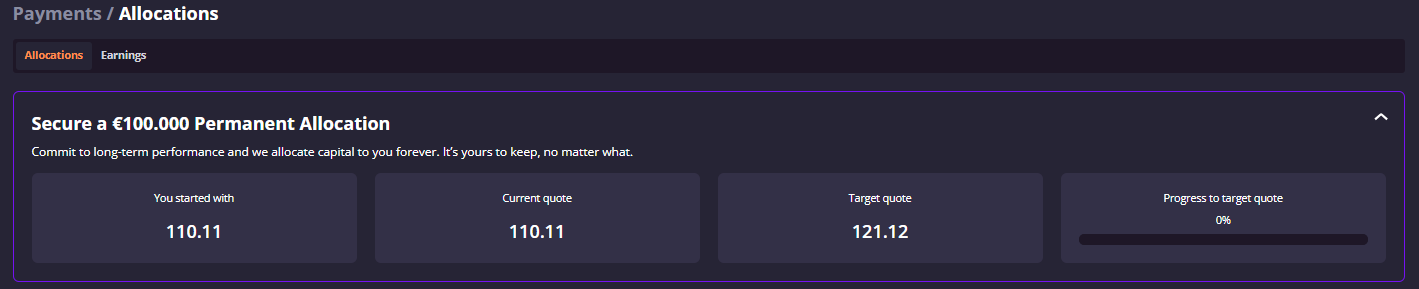

The target return is calculated based on the DARWIN's immediate quote after purchasing the permanent allocation.

Once you have made the purchase, you can see the target quote of your DARWIN to meet the return selected and a progress bar:

Can I still participate and earn performance fees on DarwinIA?

Yes, the permanent allocation is independent and your DARWIN will still participate in DarwinIA if you purchase the lifetime allocation. Likewise, you will still be able to earn performance fees on your DarwinIA allocations.

The permanent allocation would be separated from DarwinIA allocations, so each one would be calculated and paid separately.

Is it possible to lose the allocation?

Permanent allocation does not expire nor have any requirements to keep it. However, a restart of your subscription would involve losing the option purchased to receive the permanent allocation, as well as the allocation, if received.

How does performance fees on permanent allocation work?

Similar to DarwinIA performance fees, it would be payed a 15% performance fees based on the DARWIN's performance once the allocation has been received, which would be calculated and paid every 3 months since the date at which the allocation was received, with a criterion of High-Water-Mark each quarter end.

Example

Let's say you purchase the lifetime allocation with your DARWIN having +10% return since inception (or 110 quote, which is the equivalency), selecting the second option: to pay 235€ for the 15% target return.

Therefore, the lifetime allocation would be given at the point where there is +15% additional return obtained. In this case, it would be at total return since inception of (1+10%)x(1+15%)-1=26.50% (DARWIN's quote of 126.50). Let's put it's obtained at the 1st of january.

By 1st of april (3 months later), the return obtained since the allocation was given is 10%, so the performance fees paid would be: 100.000€ x 10% x 15% = 1.500€...

...and the process would be repeated and calculated by 1st of july and every 3 months.